IG Private Wealth Management | Jeff Somers & Associates

The little-known tax benefits of life insurance

By IG Wealth Management | Insurance Planning

Most people think of life insurance as a necessary expense. It’s something that you almost begrudgingly pay for, in the hope that you’ll never need it, but with the expectation that it will protect your family’s finances, should the worst happen.

↓

What most people don’t realize, however, is that life insurance can be used as an extremely useful estate-planning tool that can go far beyond keeping your family financially secure. It can help maximize your estate’s value and ensure that your will is distributed fairly, all while funding your estate’s tax liabilities.

Let’s examine the ways that life insurance can provide tax benefits, particularly for those investors with larger estates.

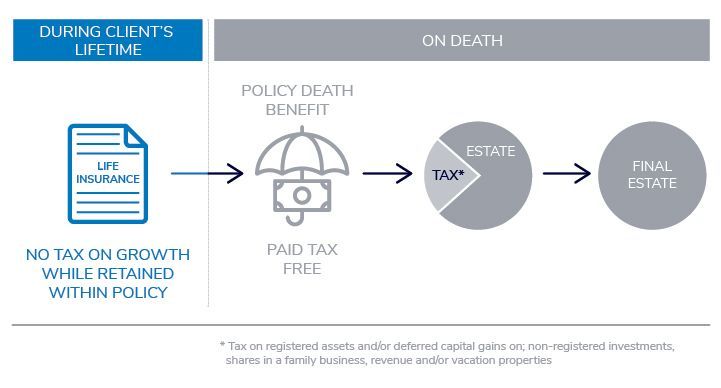

Using life insurance to preserve your estate’s value

There are numerous assets that could be extremely valuable and which could trigger a significant tax bill when you leave them in your will. These could include, for example, RRSPs, vacation or rental properties and a business.

Without an estate preservation strategy, the beneficiaries of your estate might have to sell off a considerable amount of your investment assets or even the family vacation home to cover your final tax bill.

An estate preservation strategy involves taking out a life insurance policy that will provide a large tax-free lump sum that will cover the costs of the estate’s tax bill. This means that your entire estate is left to your beneficiaries, rather than having to use a large chunk of it to cover taxes.

Also, because the insurance payout goes directly to your beneficiary, it bypasses your estate and avoids any possible probate fees.

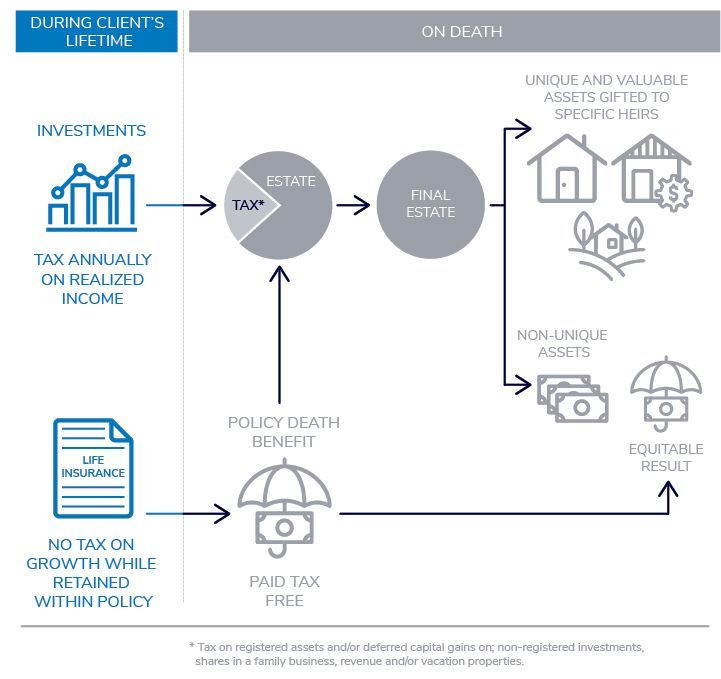

Keeping your will fair, in a tax-efficient way

Most people want to leave their wealth to their loved ones fairly, leaving the same value in assets or cash to each family member or loved one. However, this can become difficult when you have assets of widely varying values, several beneficiaries and/or a blended family.

Let’s say you have a large home and a family vacation property that you want to leave to two of your children, but you don’t want to leave out your third child. Unfortunately, after tax, the rest of your estate wouldn’t provide enough in assets and cash to ensure that your third child receives an inheritance that’s equal to those of their siblings.

In such an instance, an estate equalization strategy could ensure that all three children are treated fairly. By taking out life insurance, the third child would receive a tax-free lump sum that would balance out the values of each inheritance, so the estate is shared fairly.

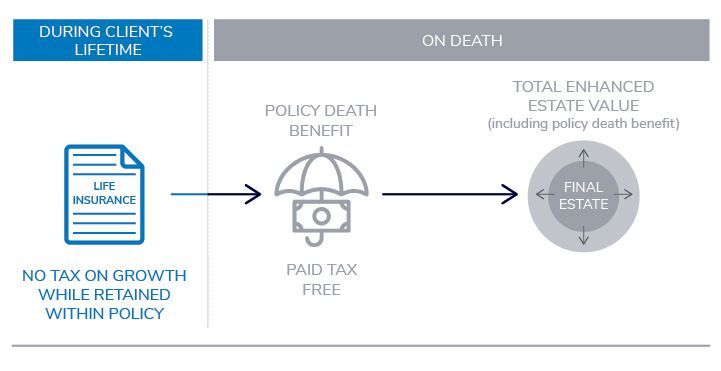

Using life insurance to maximize your estate

Some investors have more income and assets than they’ll need during their retirement years and are naturally keen on leaving a meaningful legacy for their loved ones and/or charities that they support. While many people assume that investments, real estate or business ownership can be the best ways to increase the value of their estate, all of these assets come with tax implications, both annually and when the time comes to pass them on to beneficiaries.

However, a tax-saving strategy is to reposition excess assets that bring about an annual tax burden and use the proceeds to buy a life insurance policy. By moving surplus, taxable funds into an exempt permanent life insurance policy, you could:

- Reduce the amount of taxes you have to pay during your lifetime.

- Reduce probate fees on the assets you leave in your will.

- Create a larger amount of tax-free money available to your beneficiaries when you die.

- Maximize the value of your estate.

Accessing tax-free cash

As well as paying out a lump sum death benefit, some permanent life insurance policies grow in value on a tax-deferred basis — the extra amount is called cash value. And, as a policy holder, you may be able to withdraw money from your insurance policy with minimal or zero tax consequences.

The maximum you can withdraw is the adjusted cost basis (ACB) of your policy. The ACB is the total amount of premiums paid, minus the net cost of insurance. Any amount that is withdrawn will reduce the amount paid out in the event of your death, if it’s not paid back into the policy.

The cash you withdraw from your policy is not taxable, so long as you don’t take out more than your policy’s ACB. This applies to individual policies and to insurance policies held by companies. If the death benefit is paid out in a lump sum, it would be tax free for your beneficiaries.

Personal versus company-owned life insurance

Business owners should seek advice when considering whether to take out personal insurance rather than company-owned insurance, given that both have their pros and cons.

The advantages of personally owned insurance are:

- There is creditor protection.

- This type of insurance is easy to set up and administer.

Corporate-owned insurance has its own advantages, including:

- Corporate tax rates are lower than personal rates, and so premiums are paid for with cheaper, after-tax corporate dollars.

- Growth is tax deferred, so it won’t add to the corporation’s passive investment income.

- The cash surrender value of the permanent policy is a corporate-owned asset.

- The capital dividend account can be used to pay out the life insurance proceeds to shareholders as a tax-free capital dividend.

How to maximize the tax benefits of life insurance

As with any strategies related to maximizing the tax efficiency of your estate plan and overall financial plan, it’s essential to seek out expert advice.

The team at Jeff Somers & Associates works with a group of tax and estate professionals who help provide clients with the best tax advice, even for the most complex of situations.

Contact the team at Jeff Somers & Associates about how we can help you use life insurance as a tax strategy to maximize your estate’s value and ensure your beneficiaries receive everything you have planned for them.

Author

Jeff Somers

CERTIFIED FINANCIAL PLANNER professional, RRC | Executive Financial Consultant

As a CERTIFIED FINANCIAL PLANNER professional since 2004 and frequent financial educator, Jeff specializes in tax-efficient portfolio management, providing sound advice and financial support to corporate or small business owners and retirees.

Written and published by IG Wealth Management as a general source of information only, believed to be accurate as of the date of publishing. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on up to date withholding rules and rates and on your specific circumstances from an IG Wealth Management Consultant. Trademarks, including IG Wealth Management and IG Private Wealth Management are owned by IGM Financial Inc. and licensed to its subsidiary corporations.

Share This Article On Your Channels