IG Private Wealth Management | Jeff Somers & Associates

A winning strategy to manage market volatility: Dollar-Cost Averaging

Originally Published December 2022

This article explores the use of a balanced portfolio of fixed-income investments such as bonds and equities to ensure you are properly diversified in times of market volatility.

↓

If you’re like many Canadian investors, you’ve already started planning for your retirement years through savings vehicles like Registered Retirement Savings Plans (RRSPs), typically with a balanced portfolio of fixed-income investments such as bonds and equities to ensure you are properly diversified.

Dollar-Cost Averaging: a winning strategy to manage market volatility

If you’re like many Canadian investors, you’ve already started planning for your retirement years through savings vehicles like Registered Retirement Savings Plans (RRSPs), typically with a balanced portfolio of fixed-income investments such as bonds and equities to ensure you are properly diversified.

In addition to having a well-diversified portfolio, your IG Wealth Management Consultant will work with you to develop investment strategies to help manage market fluctuations and safeguard your retirement savings. One proven strategy that takes advantage of changing prices and improves your odds of success in the face of volatility is dollar-cost averaging (DCA).

Reduce the risk of “buying high”

Dollar-cost averaging is an investing technique you may have heard of but may not know how it gets used as part of an IG Living Plan™. The concept is straightforward – by purchasing smaller amounts of a given investment on a regular basis, rather than investing up front in a lump sum, you can reduce the risk of “buying high” by spreading out the purchases over a given time period. Over time, this purchasing strategy can lower the average cost per investment unit and can help you manage unpredictable market volatility. It’s a good way to manage your investment risk and help bolster your long-term returns.

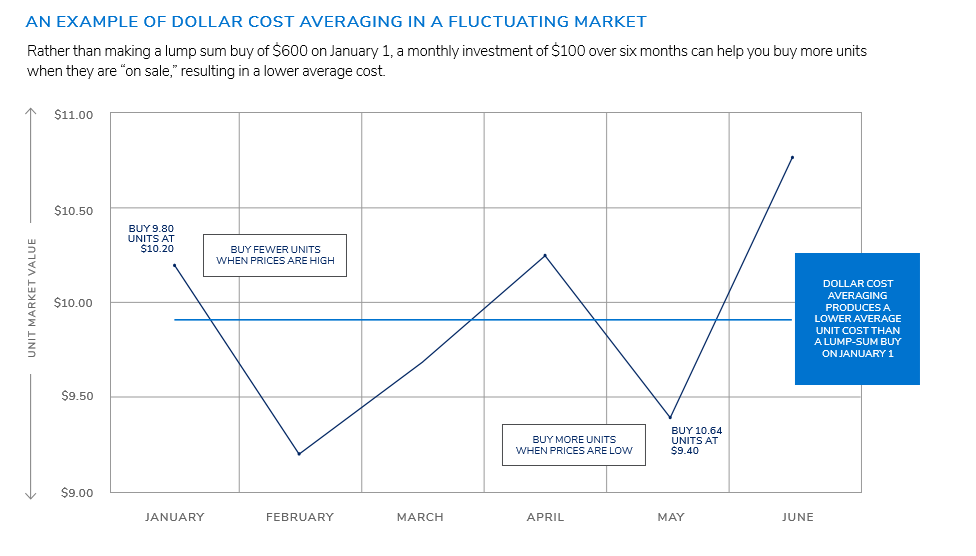

Here is an example of how dollar-cost averaging can mitigate risk in a volatile market:

- Two investors each have $600 to invest.

- Investor A chooses to purchase a given investment (for example, units in a mutual fund) through a lump sum purchase of $600 on January 1st. They buy 58.8 units at $10.20.

- Investor B takes the advice of an IG Consultant and invests $100 a month from January through June and over the course of six months purchases units at an average price of $9.90.

Figure 1. The light blue line represents the average unit cost of $9.90 when bought over six months. An investor who bought the same fund on January 1st would have paid $10.20 for each fund unit.

The result

Setting up regular contributions and taking advantage of DCA was advice that paid off for Investor B. It took the guesswork out of trying to time the market and resulted in a lower average cost. Seeing the results makes it easier to stay committed to regular contributions.

Make dollar-cost averaging part of your investment strategy

If you are still contributing a one-time, annual lump sum to your IG Living Plan, now is the time to connect with a member of the Jeff Somers & Associates team to discuss switching to monthly or biweekly contributions. Switching is easy and pre-authorized contributions (PACs) can help you take advantage of the ups and downs of the market.

Author

Jeff Somers

CERTIFIED FINANCIAL PLANNER professional, RRC | Executive Financial Consultant

As a CERTIFIED FINANCIAL PLANNER professional since 2004 and frequent financial educator, Jeff specializes in tax-efficient portfolio management, providing sound advice and financial support to corporate or small business owners and retirees.

Written and published by IG Wealth Management as a general source of information only, believed to be accurate as of the date of publishing. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Seek advice on up to date withholding rules and rates and on your specific circumstances from an IG Wealth Management Consultant. Trademarks, including IG Wealth Management and IG Private Wealth Management are owned by IGM Financial Inc. and licensed to its subsidiary corporations.

Share This Article On Your Channels